Tax Planning Tips for Freelancers [2025]

Understanding the Basics of Business Structures

Selecting an appropriate business framework ranks among the most pivotal choices facing new entrepreneurs. The structure you pick directly influences your tax responsibilities, personal liability, and daily operational demands. Grasping the fundamental distinctions between sole proprietorships, LLCs, and S-Corporations forms the essential groundwork for sound decision-making. This knowledge empowers business owners to match their organizational choice with both immediate needs and future aspirations, potentially saving substantial time and resources down the line.

Each business type carries unique implications for legal protection and administrative requirements. Critical evaluation points include: personal asset protection, setup complexity, and tax treatment. Entrepreneurs must weigh these factors carefully to support sustainable growth and operational success.

Sole Proprietorship: Simplicity and Direct Control

The sole proprietorship stands as the most straightforward business model, particularly appealing for its minimal startup requirements. This structure merges personal and business finances under single ownership, offering unmatched operational flexibility. However, this convenience comes with considerable risk - the owner assumes complete personal responsibility for all business debts and legal obligations. Personal assets like homes and savings accounts become vulnerable if the business encounters financial or legal challenges.

This model works best for small-scale operations with limited capital investment and owners who fully comprehend the potential personal financial exposure. The streamlined nature makes it ideal for entrepreneurs prioritizing quick launch and absolute control over business decisions.

Limited Liability Company (LLC): Balancing Liability and Flexibility

LLCs strike an effective compromise between the simplicity of sole proprietorships and the robust protection of corporations. This hybrid structure creates a vital legal separation between personal assets and business liabilities, offering crucial protection as operations expand. The level of security increases significantly as businesses grow and face greater operational risks.

While requiring more administrative effort than sole proprietorships, LLC regulations vary by location and allow considerable customization of management and financial approaches. This structure particularly suits entrepreneurs seeking liability protection without excessive corporate formalities.

S-Corporation: Enhanced Tax Advantages for Growing Businesses

S-Corporations present a more complex framework that delivers notable tax benefits for expanding operations. This structure avoids the double taxation dilemma by passing profits directly to shareholders' personal returns, creating potential long-term financial advantages. The tax treatment can substantially influence both business and owner tax obligations.

The increased compliance demands - including rigorous financial documentation and specific reporting requirements - often make this option impractical for smaller or newer ventures. The administrative burden typically outweighs benefits until businesses reach certain revenue thresholds.

Tax Implications and Considerations for Each Structure

Tax consequences represent perhaps the most critical factor in business structure selection. While sole proprietors report business income on personal returns, LLCs and S-Corps offer varied tax classifications requiring careful analysis. Comprehending how each model affects tax liabilities and potential deductions proves essential for financial optimization. This understanding forms a cornerstone of comprehensive business planning.

Consultation with tax professionals remains invaluable when navigating these complex decisions. Their expertise helps business owners maximize available benefits while maintaining full compliance with evolving tax regulations. Professional guidance often makes the difference between adequate and optimal tax strategy implementation.

Strategic Expense Management: Maximizing Deductions

Maximizing ROI Through Strategic Spending

Effective expense management transcends basic cost-cutting to focus on value optimization for every expenditure. This approach demands systematic analysis of current spending patterns, identification of improvement opportunities, and implementation of efficiency-enhancing solutions. Organizations prioritizing value creation over mere cost reduction frequently uncover significant financial advantages. Successful implementation requires data-informed budgeting and meticulous expense tracking.

Comprehensive expense strategies enable businesses to understand cash flow allocation and utilization effectiveness. Through evaluation of current practices, companies can pinpoint overspending areas and identify technological or procedural improvements that maintain quality while reducing costs. This analytical approach facilitates informed decision-making for leaner, more profitable operations.

Optimizing Procurement Processes for Cost Savings

Streamlined procurement systems play a pivotal role in expense management success. Effective approaches include implementing efficient purchasing protocols, negotiating favorable vendor contracts, and adopting automation for purchase order processing. Centralized procurement systems dramatically enhance spending transparency and accountability while ensuring alignment with organizational budgets and requirements.

This methodology fosters organization-wide cost consciousness while reducing administrative overhead. The resulting cultural shift toward fiscal responsibility often yields compounding benefits across all operational areas.

Leveraging Technology for Enhanced Control

Modern expense management software provides unprecedented spending visibility through real-time tracking, automated reporting, and comprehensive analytics. These tools enable proactive identification of budget variances and operational inefficiencies, allowing timely corrective action. Integration with accounting systems creates a holistic financial overview.

Automated expense reporting not only reduces processing time but also minimizes errors and ensures policy compliance. The resulting efficiency gains allow staff to redirect efforts toward strategic initiatives rather than administrative tasks.

Developing a Clear Budgetary Framework

Effective expense management requires well-defined budget parameters including spending limits, resource allocation, and regular performance monitoring. A properly structured budget serves as both financial compass and operational guideline, requiring periodic review to maintain relevance to evolving business needs.

Clear communication of budget expectations ensures organizational alignment and shared commitment to financial objectives. This transparency promotes unified efforts toward fiscal targets.

Enhancing Employee Awareness and Accountability

Successful expense management depends heavily on employee understanding and compliance. Comprehensive training on expense policies cultivates organizational accountability and cost-conscious behavior, reducing policy violations and processing errors.

Well-defined reimbursement procedures and approval workflows promote fairness and operational transparency. Investing in employee financial education consistently yields positive cultural and financial returns.

Utilizing Tax Credits and Deductions Specific to Freelancers

Maximizing Tax Savings

Strategic use of available tax credits and deductions represents a powerful financial tool for independent professionals. Proper utilization can dramatically reduce tax burdens, freeing capital for business growth or personal financial goals. Thorough understanding of eligibility requirements and application procedures proves essential for optimal benefit realization.

Consulting authoritative sources like IRS publications and qualified tax professionals helps ensure comprehensive claim of entitled benefits. This diligent approach minimizes errors while maximizing potential savings, creating long-term financial advantages.

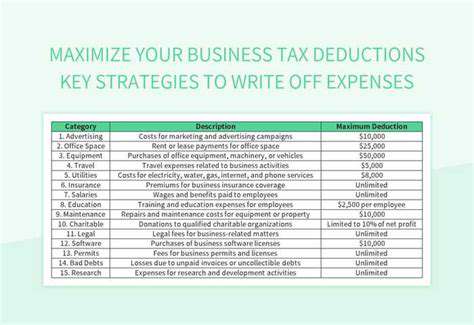

Types of Tax Credits and Deductions

Freelancers qualify for numerous specialized tax benefits spanning categories like home office expenses, healthcare costs, and retirement contributions. Understanding the specific qualifications for each opportunity enables targeted financial planning and optimal tax strategy development.

Common deductible expenses include professional development costs, equipment purchases, and business-related travel. Maintaining meticulous records substantiates these claims while simplifying tax preparation. Additional benefits may include credits for energy-efficient business upgrades or hiring assistance.

Strategies for Effective Claiming

Implementing systematic documentation practices forms the foundation for successful credit and deduction claims. Organized record-keeping ensures accurate filing while supporting potential audit defense, reducing stress during tax season.

For complex situations, professional tax guidance often proves invaluable. Qualified advisors navigate intricate tax regulations to identify all applicable benefits while ensuring full compliance with reporting requirements.

Seeking Professional Tax Advice for Personalized Strategies

Understanding Your Tax Situation

Comprehensive tax planning begins with detailed assessment of current financial circumstances. Analysis should encompass all income streams, potential deductions, existing credits, and anticipated liabilities. Reviewing prior returns reveals patterns and opportunities for improvement, forming the basis for customized strategy development.

Meticulous financial documentation - including receipts, statements, and investment records - enables accurate evaluation while reducing error potential. This organizational discipline proves particularly valuable during audits or financial reviews.

Identifying Potential Tax Deductions

Effective deduction identification requires understanding specific qualification criteria across various expense categories. Common opportunities include home office costs, professional memberships, and business-related education. Systematic tracking of potential deductions throughout the year maximizes claim accuracy and completeness.

Leveraging Tax Credits

Unlike deductions reducing taxable income, credits provide dollar-for-dollar tax liability reductions. Available credits may include those for retirement savings, healthcare coverage, or dependent care. Strategic credit utilization often yields greater financial impact than deduction-focused approaches alone.

Strategic Planning for Future Tax Implications

Forward-looking tax planning considers how current decisions affect future obligations. Major purchases, investment strategies, and retirement planning all carry tax consequences. Proactive planning helps structure these decisions for optimal tax efficiency across multiple years.

Personalized Tax Strategies

Tailored tax approaches address individual circumstances including income levels, family situations, and long-term objectives. Custom solutions might involve retirement account selection, investment timing, or education funding strategies. Properly structured plans provide immediate benefits while positioning for future financial success.

Seeking Professional Guidance

Engaging qualified tax professionals offers access to specialized knowledge and strategic insight. Experienced advisors help navigate complex regulations while identifying overlooked opportunities, often recovering multiples of their cost in tax savings.

Ongoing professional relationships provide year-round guidance, ensuring compliance while optimizing financial decisions. This proactive approach frequently prevents costly errors and missed opportunities.

Read more about Tax Planning Tips for Freelancers [2025]

Hot Recommendations

- Best Investment Strategies for Income Generation

- Budgeting for Pets (Unexpected Costs)

- Growth Investing Explained: Is It Right for You?

- Best Budgeting Strategies for People with Variable Income

- How to Use Momentum Investing

- Tips for Managing Credit Card Rewards While in Debt

- Best Investment Strategies for Short Term Goals

- How to Budget for Unexpected Expenses

- Best Investment Strategies for Young Investors

- How to Budget for Hobbies

![Best Investment Strategies for High Inflation Environments [2025]](/static/images/30/2025-05/BeyondtheBasics3AExploringAlternativeInvestments.jpg)